GREECE

GDP 2022

POPULATION 2024

Total investment in construction in 2022

Overall construction activity

The Spanish economy grew in 2022 in comparison to 2021, the GDP registered a variation of 5,5% in terms of volume; this means a slightly higher growth than forecasts, in general, had set last year in a context marked by the impact of the Russian invasion of Ukraine, the high rate of inflation and particularly the sharp increase in the price of energy and other raw materials. The implementation of the national Recovery and Resilience Plan is playing a role in the recovery of the economy, although the rhythm of the allocation of funds to the real economy in 2022 was slower than expected.

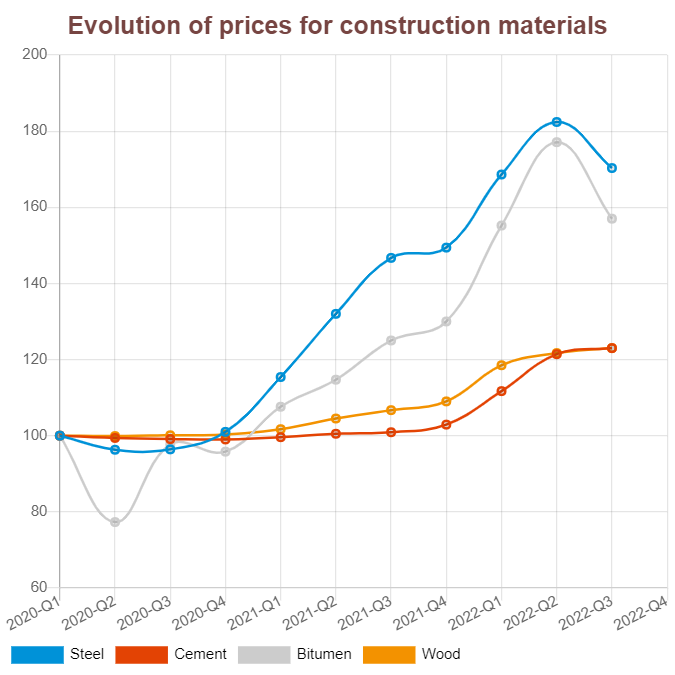

In the above-described scenario, construction sector struggled to perform. Two main aspects must be noticed. Firstly, the exorbitant increase in the price of energy and materials for construction and the negative impact that the lack of an adequate price revision system is having on companies that carry out public contracts, despite the exceptional mechanism -temporary and with a series of restrictions- that the Government approved in 2022. Secondly, the shortage of workers, especially young people, willing to join the sector while active workforce is aging. These facts are reducing the deployment of the sector potential.

Employment in Spain also grew in 2022 in comparison to 2021, around 1,4%. Regarding construction sector, estimates show an increase in employment around 3,5%. It is worth noting that only 9,2% of the workers in construction are under 30 years old, in 2008 that percentage was 25%.

The implementation of the national Recovery and Resilience Plan must lead to a clear reactivation of construction activity, since construction sector has a key role due to building renovation objectives and investments in the field of mobility (urban and long-distance infrastructures) and environmental infrastructures. However, the impact of NextGeneration funds could be lessened if Public Administrations do not adopt proper measures in order to minimise the impact of the increase of energy and materials prices in on-going public contracts and future ones, both in building and civil engineering works. Moreover, construction sector would need the support of Public Administrations for our urgent task of attracting young people and women.

Housebuilding

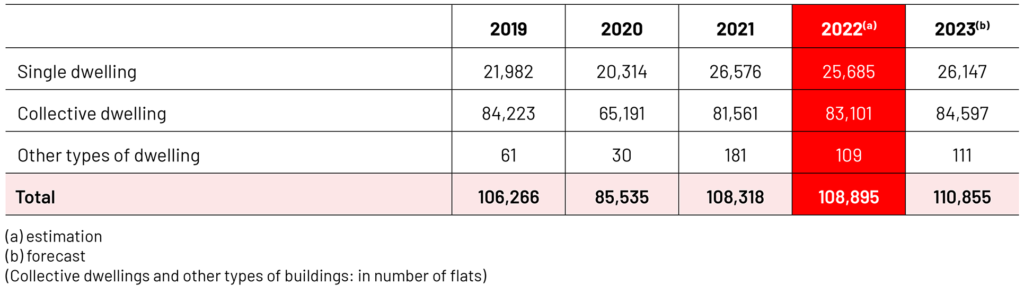

The number of “visados de dirección de obra” in 2022 stated at 108 895, a similar level as the one observed in 2021. This data didn’t meet the expectations of a clear recovery in this segment.

Regarding the real estate market, in 2022 there was a significant rise in sales, although the rise in new housing sells just reached a variation of 2,6%.

With regard to the buying of dwellings by foreigners, in 2022 this has continued the recovery started in Q2 2020, representing the 16% of the total and amounting to 90 000 units in Q3 2022.

The situation of uncertainty remains, with construction costs still very high, inflation which is affecting households purchasing power and rising interest rates. However, sectoral analysts continue to maintain a positive perspective as long as the employment rate does not diminish.

With regard to the renovation segment, it is worth noting that the national Recovery and Resilience Plan is going to allocate around 10% of its budget to an ambitious renovation and urban regeneration plan, where residential renovation, linked to the improvement of energy efficiency, is the main field of action; the expected positive impact in sectoral activity was not really perceived in 2022 but should it be in 2023.

Non-residential construction

Its recovery is also expected to happen, based on the gradual recovery of business activity, especially in industry, transport and commercial services and offices. Leisure and tourism are clearly recovering too, fact that should contribute to the reactivation of this segment. Public activity is expected to increase as well.

Civil engineering

In 2022 the volume of public tenders increased notably because of the investments included in the national Recovery and Resilience Plan. But the problem of price increases in materials and the lack of adequate price revision mechanisms in public contracts had a very negative impact on the development of construction activity and on companies.

One of the consequences has been the fact that there have been an important number of public tenders where no bidder has presented an offer; CNC, through its member associations, has identified 1 939 public tenders in the period October 2021-October 2022.

Forecasts related to 2023 may anticipate a substantial recovery in activity; in this case, as explained before, the impact of European funds will be important; nevertheless, it is crucial the adoption by the Government of adequate measures for price revision in public contracts.

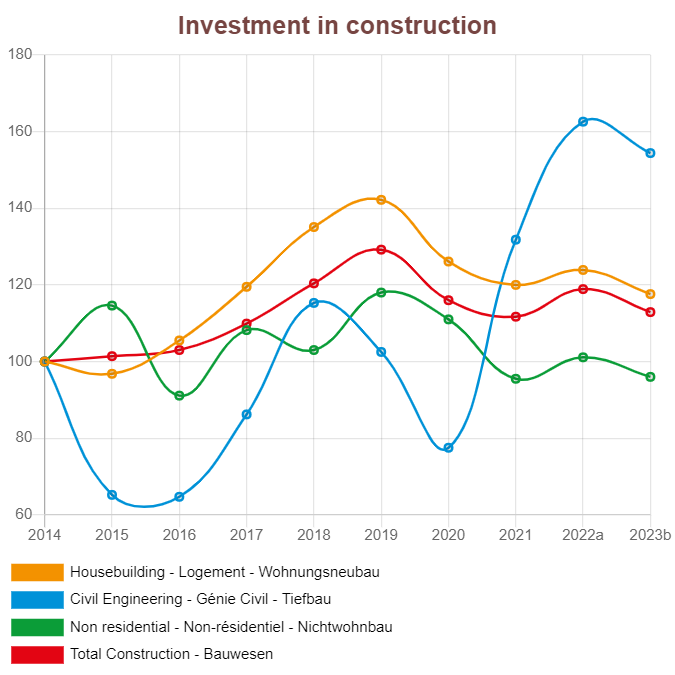

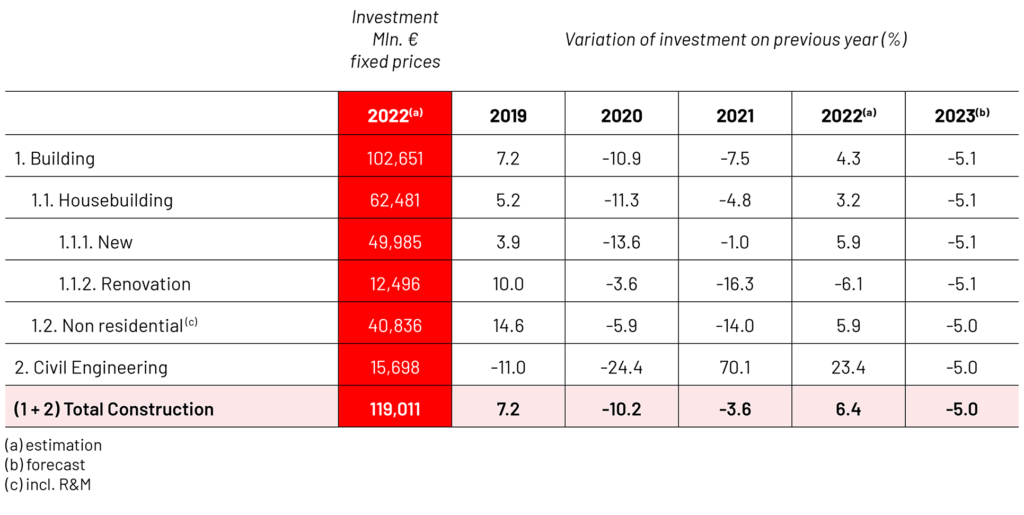

Per cent variation of investment in real terms of previous year

Number of building permits in residential construction