GERMANY

GDP 2022

POPULATION 2024

Total investment in construction in 2022

Overall construction activity

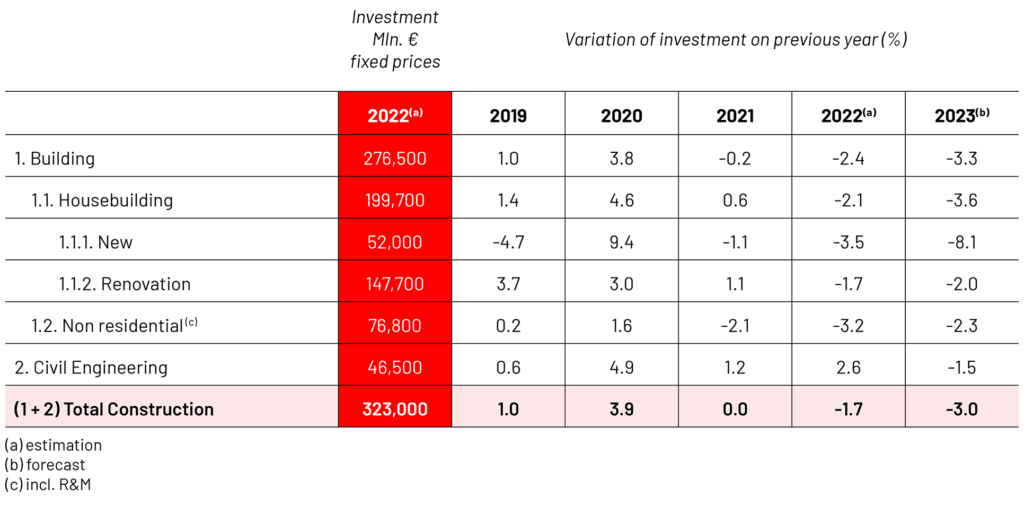

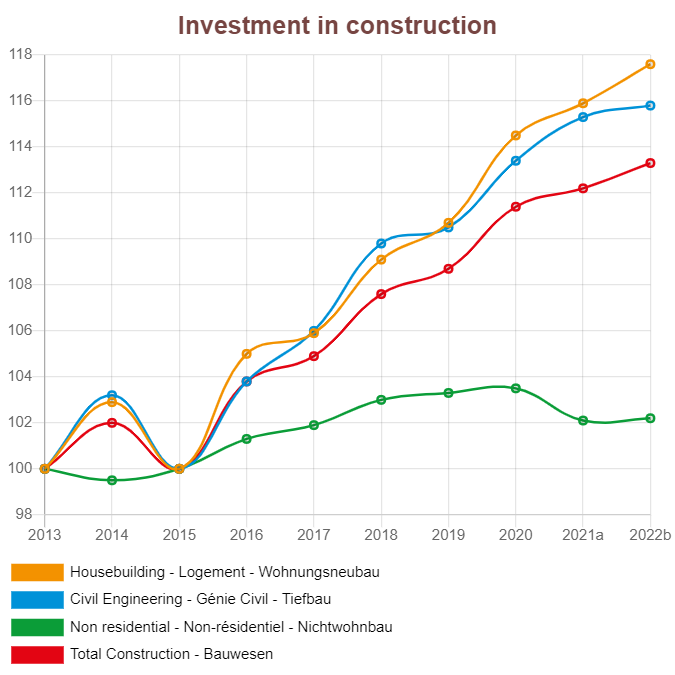

After the construction industry had still supported the overall economy in 2020 and 2021, the trend reversed in 2022. While real GDP rose by 1,8%, construction investment adjusted for price fell by 1,7% — after a twelve-year growth phase. The picture for employment was somewhat different. An increase in the economy of 1,3% contrasted with lower growth in the construction sector of 0,5%.

The war in Ukraine led to a sharp rise in the cost of construction materials, which was also reflected in higher prices for construction services. The 15,9% increase was the strongest in decades. This was the only way to achieve a new nominal record volume of gross fixed capital formation (GFCF) in construction of €475 billion. The real growth rate in civil engineering (+2,6%) contrasted sharply with developments in building construction, which fell by 2,4%. Commercial building construction was hardest hit (-3,0%), followed by housing construction (- 2,2%) and public-sector building construction (-1,0%).

The problems facing the construction sector have changed significantly. Energy and material prices are now the biggest threat to construction companies, cited by 81% of them in January 2023. Another 67% report risks due to a shortage of skilled labour, and 58% due to a lack of demand.

The expectations for the construction sector in 2023 are negative. GFCF in construction will decline by 3% in price-adjusted terms, with civil engineering (-1,5%) — as in the previous year — showing the better development than building (-3,3%).

In 2021, orders for construction were worth €94,6 billion, 9,4 % more than in the previous year. The volume of permits for new buildings (excluding civil engineering) was just under €110 billion, 8% more than in the previous year, mainly due to rising construction prices. GFCF in construction is expected to grow by 1% in real terms this year. Construction prices are expected to rise by 7% this year due to the massive price increases for building materials and energy.

In 2022, new orders had a volume of €99 billion, 4,8% more than a year earlier. This supposedly positive development is also only due to the high construction price increases; in real terms, incoming orders were 9,7% lower than in 2021. For the same reason, approvals for new buildings also rose significantly once again to €120 billion, but in real terms this also means a significant decline. Prices for construction services, which rose by around 16% in 2022, are expected to increase by a further 6% in the current year.

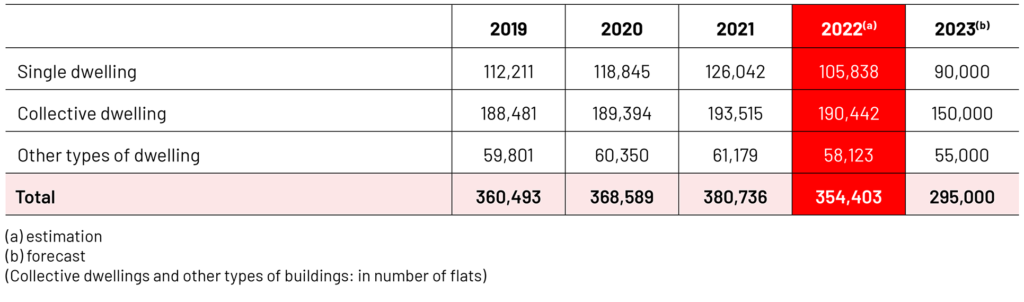

Housebuilding

The uninterrupted upward trend in this sector (62% of total construction investment) came to a stop in 2021. In 2022, real construction investment in this sector declined by 2,1%, and the number of completed dwellings fell to about 280 000 units.

Most of the positive framework conditions that had spurred the recovery in the years 2009 to 2020 have now turned into their opposite. Mortgage interest rates for contracts with a term of more than 10 years have risen from 1,4% to 3,5% in 2022. The disposable income of private households has fallen significantly due to the high inflation rate. Construction prices have risen significantly and will be driven up further in the current year.

This has ensured that the number of approved dwellings in 2022 has fallen by 7%. In addition, the state will only provide €1,1 billion for the promotion of energy-efficient new housing construction in the current year, and only if standards are further tightened. As a reaction to this, many real estate companies have announced that they will completely forego the construction of new flats in certain regions by 2023 or significantly reduce their activities. The federal government’s political goal of having 400 000 new flats built annually is thus moving further and further away.

It doesn’t help much that at least the subsidies for social housing will be further increased. In 2022, €2 billion will be available for this, in 2023 €2.5 billion and in 2024 €3 billion. However, this will be almost completely devalued by the high increases in construction prices.

For investments in the housing stock, the situation looks better in the current year. State subsidies remain unchanged, and the sharp rise in energy prices (which will probably remain high in the future) ensures that private homeowners and real estate companies are very interested in energy-efficient renovation measures.

New housing construction is also being held back by high land prices. Prices for land ready for construction in Germany have risen by 80% per square metre from 2010 to 2021, and by as much as 160% in the major conurbations. Since there is not enough building land available, this development is also driving up investment costs in new residential construction.

In 2023, the number of completed flats in new construction and conversion is expected to fall further to 240 000 units and thus continue to lag significantly behind demand.

Non-residential construction

About 80% of the production in this sector is determined by commercial investors, so the development is also relatively strongly linked to the general economic trend. In view of a low GDP growth rate of 1,8% last year and stagnation in the current year, investors will hold back for the time being for reasons of caution. This is already reflected in last year’s permit development, where building permits in commercial building construction (estimated construction costs) fell significantly by 6% in real terms.

In public building construction (as in civil engineering) there is the problem that the budgets of the federal government, the Länder and the municipalities are drawn up in nominal terms and therefore last year, in view of the significant increase in construction prices, there was not enough money available for the measures that were planned. This will also be the case in the current year; permits for public builders fell by 11% last year, adjusted for prices.

The refurbishment of existing buildings plays a much smaller role in non-residential construction than in residential construction. It is true that owners will also strive to get their energy costs under control by investing in energy efficiency (heating systems and insulation of walls and roofs). However, this will by no means compensate for the decline in new construction. Adjusted for prices, investments in this sector will decline by almost 2%.

GDP 2023

BILLION

POPULATION 2024

Total investment in construction in 2022

BILLION

Civil engineering

Investments in civil engineering have shown a real growth rate of 16% from 2022 to 2024, compared to only 5,4 % in building construction. On the one hand this is because public builders (80% of whose investments flow into civil engineering) have expanded their activities. In addition, Deutsche Bahn AG’s investments in the existing network and new construction have also been significantly expanded, primarily on the base of state aid.

The positive development will come to an end in 2023. While new orders in commercial civil engineering will still increase slightly in real terms in 2022, there will be a significant decline in public construction, which is particularly pronounced in road construction with -6,1%. As already explained, the increases in nominal budgets were more than offset by the strong construction price increases. In view of the high costs due to the consequences of the Ukraine conflict (especially for the reception of refugees), a significant increase in public construction activity is not to be expected in the current year, which will then also be reflected in a significant real decline.

This will be particularly evident at the municipal level, the most important client for the construction industry. Significantly higher wage settlements (against the backdrop of the high inflation rate) are to be expected here, which will weigh heavily on the expenditure side and probably curtail investment.

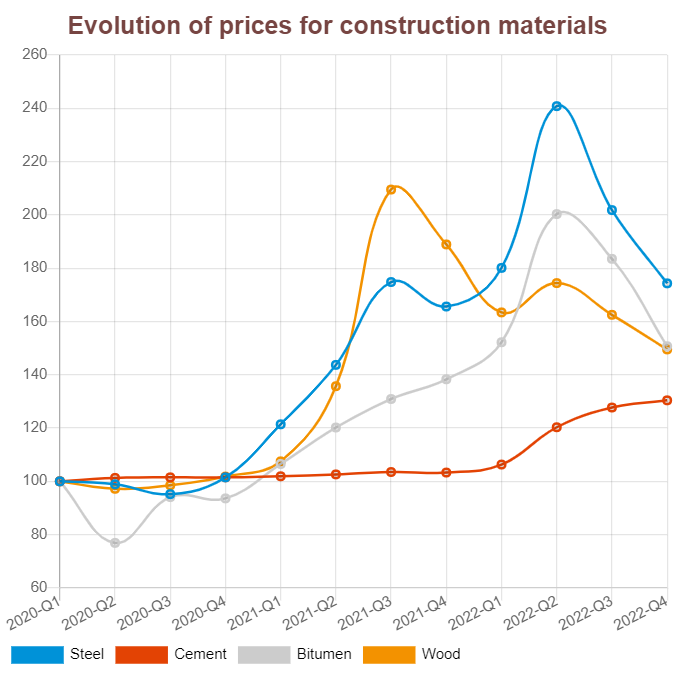

Prices of construction materials

The year 2022 was marked by a shortage of building materials. At the peak in May, every second construction company complained of production being hampered by a lack of materials. By December, the figure had dropped to 20%. No further major problems are expected for the current year.

At the same time, prices for construction materials rose rapidly in 2022, especially for materials that require a lot of energy to produce. On average for the year, prices were 49% higher than in 2021 for flat glass, 38% for bitumen, 32 % for reinforcing steel, 21% for thermal insulation boards and 20% for plastic pipes. A sideways movement is expected for 2022, but the 2023 level will probably be exceeded permanently.