GREECE

GDP 2022

POPULATION 2024

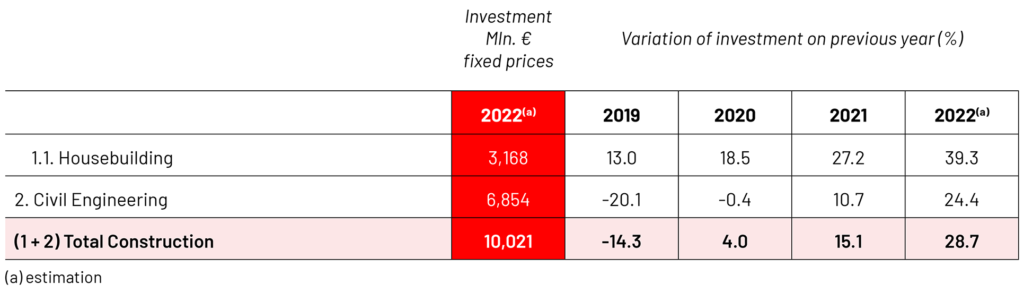

Total investment in construction in 2022

Overall construction activity

Tourism is Greece’s biggest revenue earner, set to bring in more than €18 billion in 2022 as the Covid-19 pandemic waned, but the construction industry is right behind it and is recovering fast.

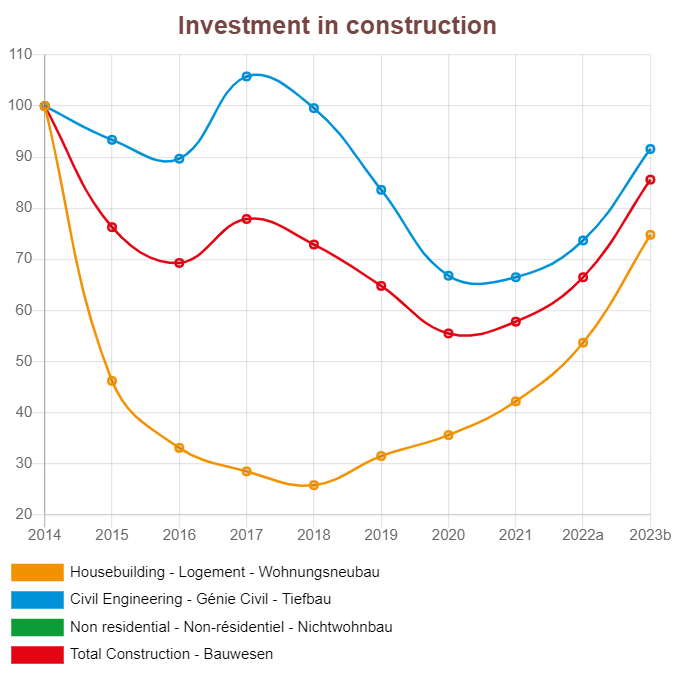

The pressures the construction sector has faced since 2012 are multifaceted: low investment and significant declines in productivity, turnover and staffing are some of them. The turning point for the sector comes in 2018. Despite the onset of the pandemic, the sector appears resilient and ready to cope. Positive signs include major investment plans in logistics, data centres and green building.

Over the last two years, the construction sector in Greece has entered a recovery phase and is once again contributing to the country’s growth momentum. In particular, the contribution of construction to the increase in gross value added (at constant prices) was positive for the second consecutive year in 2022, while the sector’s turnover increased by 22,6 % in nominal prices and by 14,5 % in deflated prices. The sector’s contribution to the reduction in unemployment last year was also significant. The dynamism of the construction sector is also reflected in: (i) production indicators, which have risen over the past two years; and (ii) improving business expectations, especially in private construction. It is particularly important to note that this recovery in the sector’s activity has been achieved in an adverse international environment, characterised by the energy crisis, the war in Ukraine and the strong resurgence of inflationary pressures on input prices.

Construction investments are increasing at an accelerated rate from 2020 onwards, while last year they had the highest contribution (8,6 units) to the increase in total investments (11,7%). The sector’s prospects for the coming years are significantly strengthened, by the investments expected to be made in the context of the implementation of programs such as «Next Generation EU» and the absorption of the resources of the Recovery and Resilience Fund (2021-2026), the Corporate Agreement of Regional Development (NSRF) 2021-2027 and are related to the energy upgrade of the country’s building potential, urban renewal strategies, etc.

The Construction Production Index in Greece increased by 23% in 2022 compared to an increase of 6% in 2021. From 2017 to 2020, this index followed a downward trajectory, while the consecutive increases of the last two years covered 77% of the losses. The growth rate of the production index in construction in Greece was the highest among the countries of the European Union (EU-27) in 2022. Greece, in fact, is one of the 6 countries of the EU-27 in which the largest cumulative rising index between 2019 and 2022. The others are Romania, Italy, Croatia, Malta, and Slovenia.

The Construction Business Expectations Index, which shows considerable volatility, rose to 18,6 points in March this year, its highest level since October 2003 (19 points). Although the moving average of the last six months remains negative, as the index was in negative territory from November 2021 until January of this year, it is following a strong upward trend in the early months of 2023. Among the individual categories that make up the construction industry’s business expectations index, forecasts for the volume of work, although negative, improved markedly from one month to the next, while the positive forecasts for employment continued to strengthen.

As for construction projects (private construction), the business expectations index improved by 16,6 points in March compared to the previous month, rising to the highest level recorded since the time series began in 2000. Significant improvements were the estimates of the businessmen of the sector for the current course of work and for their work program in the next period.

Investment is expected to grow very strongly over the projection horizon (2022-2025), averaging 10% per year, supported by the improved liquidity situation of the banking sector and the use of available European funds. In particular, over the coming years, Greece will receive around €40 billion in support from the EU’s long-term budget in 2021-2027 and €30 billion from the Recovery and Resilience Facility until 2026. These funds are expected to leverage additional private resources. At the same time, Greece is expected to attract increased foreign direct and indirect investment.

Construction is expected to pass €14 billion in 2023. That would be growth of 4,8% and showing the acceleration of a key industry in the country that was held down for years, first by an eight-year economic and austerity crisis and then during the Covid-19 pandemic. For all those woes, medium to long term growth story in Greece remains intact and the construction industry in Greece is expected to grow steadily over the next four quarters. The growth momentum is expected to continue, recording an annual growth rate of 4 percent through 2027 when the industry is in line to reach €16,4 billion.

The strong growth of economic activity was accompanied by significant improvements in the labour market during the first nine months of 2022. Headcount employment rose by 6,6% year-on-year, the unemployment rate dropped to 12,6% and long-term and youth unemployment rates declined considerably. The labour force grew for a sixth consecutive quarter after a long period of continuous contraction. At the same time, there are signs of a labour market tightening, as in certain sectors (e.g., tourism, construction and manufacturing) labour demand, particularly for higher-skilled positions, seems to be harder to meet than in the recent past. However, data available up to October 2022 suggest a slowdown in employment growth in the second half of the year.

Construction employment increased by 4,8% in 2022, while wages and salaries moved strongly upward (5.8%).

The gradual decline in unemployment and the increase in headcount employment are expected to continue in 2023-2025, as a result of a gradual pick-up in economic growth, which should be supported by the implementation of the National Recovery and Resilience Plan.

The skill mismatches observed after the pandemic remain a serious problem, with firms finding it difficult to hire suitable staff, as workers either lack the required skills or have shifted to other sectors with better employment prospects

Housebuilding

In 2022, the Greek property market attracted strong investor interest and demand for residential and prime commercial properties. However, despite the continued momentum, the increasing cost of materials and energy, the rise in interest rates and inflationary pressures have already had a visible impact, with a decline in construction activity and expectations for the real estate sector. The fact that the observed increase in prices and demand for prime real estate is closely linked to the inflow of foreign funds makes the prospect of continued strong growth in the real estate market vulnerable to international headwinds, especially in terms of energy supply and costs. However, interest in the Greek property market, particularly in the prime segment, remains strong and is expected to remain so in the period ahead, supported by major development projects in the Attica region and infrastructure improvements throughout the country.

Civil engineering

The ‘Ellinikon’ project and infrastructure projects such as the Thessaloniki metro and Athens metro line 4, Motorway 90, new ports and airports offer a new and refreshing outlook for the construction sector.

Among the individual indicators that make up the production index for construction, the production index for building construction, which mainly corresponds to private construction, recorded an increase of 17% in 2022, while the production index for civil engineering, which corresponds to public construction, increased by 28%. In 2021, the two indices had risen by 13% and 2% respectively.

The business expectations index for civil engineering projects (public works) was formed in March at -6.3 points, at about the same level as in February, but significantly improved compared to the second half of 2022 (-38 points on average).

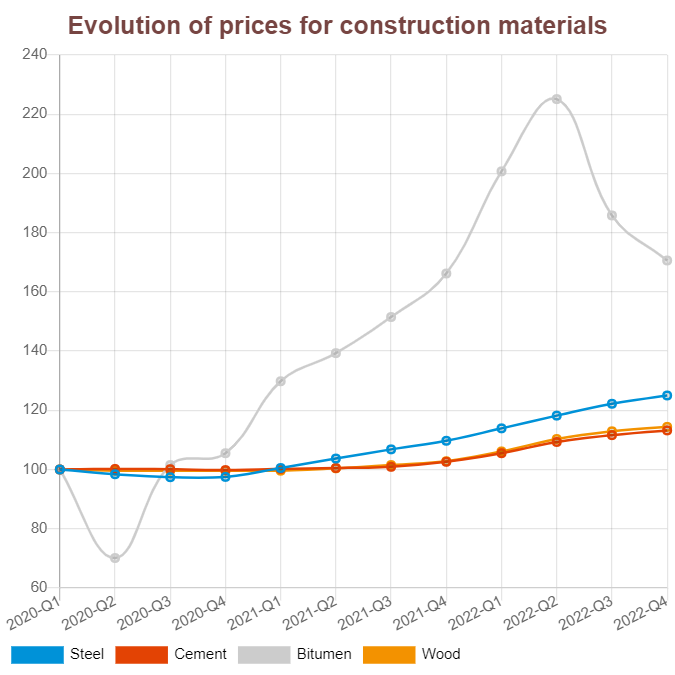

Prices of construction materials

According to EUROSTAT, the construction cost index stood at 114,7 points in December 2033. The record low of 78,10 points was reached in March 2022. Higher construction costs reached a maximum of 50% before and after the pandemic and Russia’s invasion of Ukraine. Specifically for December 2022, the Greek statistical authority said that construction materials recorded increases of 11,7% year-on-year.

The rate of increase in the cost of raw materials for new construction, which had risen sharply in the previous two years, is gradually declining.

The cost of raw materials for new buildings is reflected in the price index for new building materials, which will increase by 11% in 2022, compared with an increase of 3.8% in 2021 and a slight decrease (-0,2%) in 2020. The increase in prices is attributed to the disruption of supply chains caused by the pandemic crisis, on the one hand, and to the inflationary pressures observed since autumn 2021, aggravated by the outbreak of the war in Ukraine in February 2022, on the other.

The two main categories of materials that significantly influence the evolution of the index — as their combined weight exceeds 40% — are mortar and ready-mixed concrete and metal materials for basic processing, whose prices record an increase of 8,7% and 13,9% respectively in 2022. Energy products, which have a low weight in the overall price index for new building materials (1,9%), increase by 34% in 2022. It is worth noting that in the first two months of 2023, the rate of increase of the new building materials price index, but of the two main categories (mortar and concrete, metal materials) has slowed down, while the prices of machinery fuel (diesel) and electricity have decreased by 7,3% on an annual basis.

Per cent variation of investment in real terms of previous year