GREECE

GDP 2022

POPULATION 2024

Total investment in construction in 2022

Overall construction activity

The Italian economy registered a positive performance in the course of 2022, exceeding the expectations of most economic observers, which were downward revised following the start of the war in Ukraine. The national accounts data for 2022 confirmed a 3,7% trend increase in GDP on annual basis, after the exceptional +7% in 2021.

Growth turns out to be driven by domestic demand, especially in the investment component (+9,4% for 2022) with the outstanding contribution provided by the construction sector that, over the last two years, has represented the main growth engine of the Italian economy. According to the estimates by ANCE, roughly one third of GDP growth in the considered period is accounted for by the construction sector.

The European Commission projects Italy’s GDP to grow 0,8% in 2023. The new forecast considers a recovery in consumption expenditures in the second half of the year and the actual launch of public investments included in the National Recovery and Resilience Plan (NRRP).

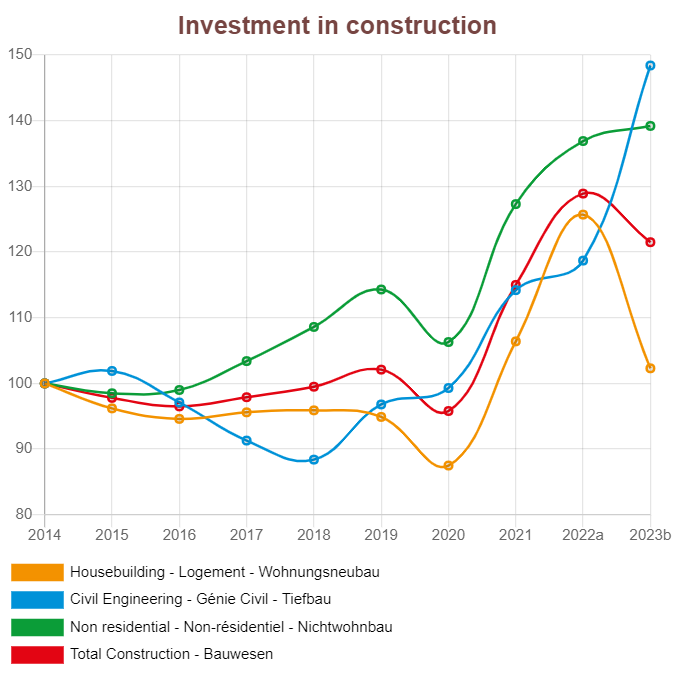

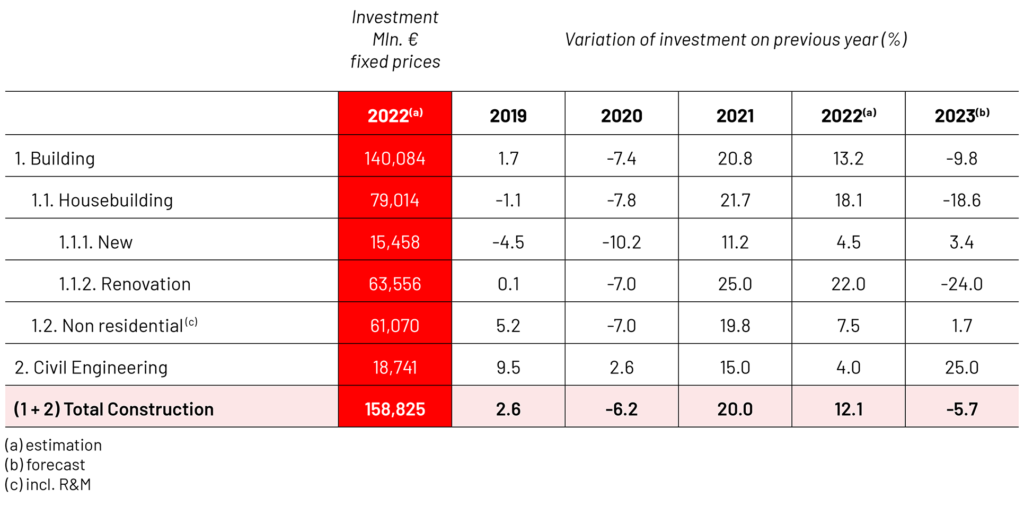

The year 2022 has confirmed the positive signs for the construction sector and ANCE’s estimate reports a significant 12,1% increase in real terms which reinforces the important 20,1% growth Year-over-Year (YoY) occurred in 2021. Such a relevant growth allows for a full recovery of pre-Covid levels, following the 6,2% decline recorded in 2020.

The positive trend is shared by all sub-sectors, and is determined, in particular, by extraordinary levels in housing maintenance. Investments in housing renovation, which now accounts for a staggering 40% of the sectoral total, recorded a further and relevant increase of 22%, following the extraordinary leap already recorded in 2021 (+25% YoY).

ANCE estimates a 4% increase for 2022 (YoY) in civil engineering. The contained estimate is the result of the price tensions in the raw materials and energy markets in combination with the limited administrative capacity of the designated authorities, which slowed down the start of the NRRP implementation phase.

Equally favourable was the trend of housebuilding that, despite a negative fourth quarter, registered a 4,8% growth in the number of housing transactions compared to 2021. The estimate derives from the slightly higher increase of housing transactions in regional capitals (+5,6%) compared to that in other municipalities (+4,4%).

The early negative signs recorded towards the end of last year and resulting from the uncertain economic context characterised by the soaring inflation and by the interest rates raises operated by the European Central Bank (ECB) suggest the risk of a future slowdown, if not a trend reversal.

The high inflation and the consequent increase in interest rates on mortgages are, indeed, factors calling for prudential behaviour and suggesting estimates of contained consumption levels and increased precautionary savings. In fact, keeping households’ income unvaried, their access to credit becomes more difficult.

In the light of the importance of the credit market for the construction sector, evidenced by a share of mortgage-backed housing sales accounting for more than half of the contracts stipulated, these dynamics will inevitably display a strong impact on the activity levels of the residential market.

The recovery of sector production levels also exerted a positive effect on employment. According to the Labour Force Survey conducted by ISTAT, the number of construction workers increased in 2022 by 8.4% (YoY), following the already solid increase in 2021 (+7.7% YoY).

ANCE’s outlook for 2023 envisions a decrease in construction investments of 5.7% compared to the high values achieved in 2022. The forecast considers the clear signs of a slowdown, mainly due to the uncertainty of the macroeconomic context. The reality of an enduring war and of geopolitical tensions, the surge in the price of materials, and the discontinuation of transferability of tax credit accrued through invoice discounts all have negatively affected companies’ investment decisions, limiting sector growth.

Housebuilding

ANCE estimates that investment in housebuilding increased in 2022 by 18,1% YoY in real terms, driven by the investments in extraordinary housing maintenance (+22%). The outstanding result is ascribable to the tax incentives linked to the redevelopment of the housing stock, above all the “110% Superbonus” measure that has functioned as a growth engine with enormous potential, not only due to the speed of its economic effects, but also because it has led to an actual energy modernisation of the real estate existing stock, pushing for the reduction of the ecological footprint of the Italian building heritage, and fostering the research and use of innovative materials.

In this context, a fundamental role was played by credit transfer mechanisms and invoice discounts, which made it possible to limit the financial commitment of citizens, making the measure accessible also to people belonging to lower income brackets.

ANCE estimates a real terms 4,5% increase YoY in 2022 in new housebuilding investment connected to the positive trend in construction permits started in 2016.

ANCE’s outlook for 2023 envisions a mild 3,4% increase in new housebuilding investment due to a sharp 24% decrease in the investment for the redevelopment of the existing housing stock. The contained outlook is mainly deriving from the downsizing of the Superbonus tax deduction from 110% to 90% for all the new interventions approved starting from January 2023 and, more importantly, from the discontinuation of tax credit transferability, which not only risks limiting future investments, but also endangers already undertaken construction works.

Non-residential construction

Private investments in non-residential building marked a real term increase of 8,2% YoY in 2022, confirming the positive trend started in 2016, just briefly interrupted by a negative result in the first year of the pandemic.

The estimate takes into consideration the robust positive trend in non-residential building permits started in 2015, as well as the favourable macroeconomic context allowing Italy to grow more than EU average. In fact, this segment is significantly affected by the performance of the various sectors of economic activity, which up to the third quarter of 2022 showed, in aggregate, positive increases in both business cycles and trends.

The outlook for 2023 private non-residential building envisions a 3% decrease in production levels. A better result for this segment could have been formulated if it had been accompanied by a generally more stable economic context, as the non-residential investment segment is, indeed, among the most affected by the dynamics underway in other sectors of economic activity.

Civil engineering

ANCE estimates a 4% growth for civil engineering in 2022 YoY. The estimate falls short of expectations mainly due to the soaring of building material prices since 2020, and to the surge in energy prices. Moreover, the limited administrative capacity of the designated authorities, finding themselves burdened with a considerable amount of resources and projects to be managed in a very short period of time, had the consequence of slowing down the start of the NRRP implementation phase, right when the grand European Plan assigned a primary role to the construction sector for the Country’s development and growth. Suffice it to consider that about half (108 billion) of the 222 billion euros programmed are intended for investments in the construction sector’s area of interest.

ANCE’s outlook for 2023 envisions a considerable 25% increase (YoY) of investment in civil engineering, mainly based on the expectations connected to the use of NRRP resources. More in detail, official government documents provide a 41 billion euros estimate for investments linked to the NRRP in the year 2023. In addition to the continuation of the NRRP works in progress, these resources also include the start of new works involving local authorities, which account for approximately 45% of the funds destined for civil engineering, such as the construction of schools, the seismic upgrading of public buildings, and urban regeneration interventions.

As a result, a consolidation of the implementation phase of the NRRP is expected in the year 2023, especially in the part pertaining to local authorities, notwithstanding the persistence of the risks already responsible for the aforementioned delays i.e., the surge in material prices, the limited administrative capacity of designated authorities, primarily those at the local level, and the shortage of manpower and qualified professionals in the construction sector.

The year 2023 started with the first signs of a slowdown in price dynamics, following a 2022 in which the costs of energy goods and raw materials climbed to a ten-year peak or, in some cases, even hit their all-time high. The available indicators show how the price increases, already recorded as early as the end of 2020, following the post-pandemic recovery, and significantly accentuated following the outbreak of the Russia-Ukraine conflict, have finally reached their peak.

More specifically, in January 2023, the price of both electricity and natural gas fell sharply compared to the values recorded in the same period of the previous year (-22.3%, and -25% respectively), reaching levels comparable to those of September 2021. Such a drop was mainly due to a lower-than-expected demand for natural gas, as the combined result of a mild winter, the reduction in household consumption, and the still high European gas stocks.

The drop in the price of energy consequently influenced the cost of plastic materials, which reported decreases, both on a monthly and on an annual basis. The price of bitumen is also decreasing, continuing the trend that started in June 2022. In January, the price of bitumen settled at levels similar to those recorded in September 2021, which however remain significantly higher than the average calculated for the months following the lockdown.

On the other hand, the prices of non-energy commodities are still increasing. In January 2023, the cost of metals was still on the rise, primarily fed by the recovery prospects of the Chinese economy due to the lift of mobility restrictions, and to the restocking carried out in the period preceding the Lunar New Year. Prices on the iron and steel markets continue to rise, reporting further increases for iron reinforcing bar (+6.4% YoY) and for copper, which during 2022 had shown a modest yearly increase of 6.1% and now recorded a further increase of 5.7% in January 2023 month-over-month (MoM).

In an attempt of contrasting those price increases and their impact on construction costs, the Italian Government introduced a number of measures in the 2023 Budget Law providing contributions in the form of tax credits to companies for the purchase of electricity and natural gas, as well as the extension to the current year of the important measures already envisaged in 2022, allocating further substantial resources to acknowledge the higher costs incurred by companies, both for the start of new construction projects and for ongoing construction sites.

Unfortunately, the measures adopted so far have proven to be ineffective in dealing with the emergency because of their long implementation times. Suffice it to consider that, as of January 2023, only 13% of the funds allocated for the higher costs of the second half of 2021, and just a mere 2% of the funds for the period January-July 2022 had been paid by the Italian Ministry of Infrastructure and Transport, and that the funds for the period August-December 2022 had just entered their investigation phase.

At this pace, companies will have to wait for years before receiving the granted financial resources, with the risk of an upcoming stop in the already initiated construction works, as well as a postponement of the time schedules for planned works, particularly those envisioned in the National Recovery and Resilience Plan (NRRP).

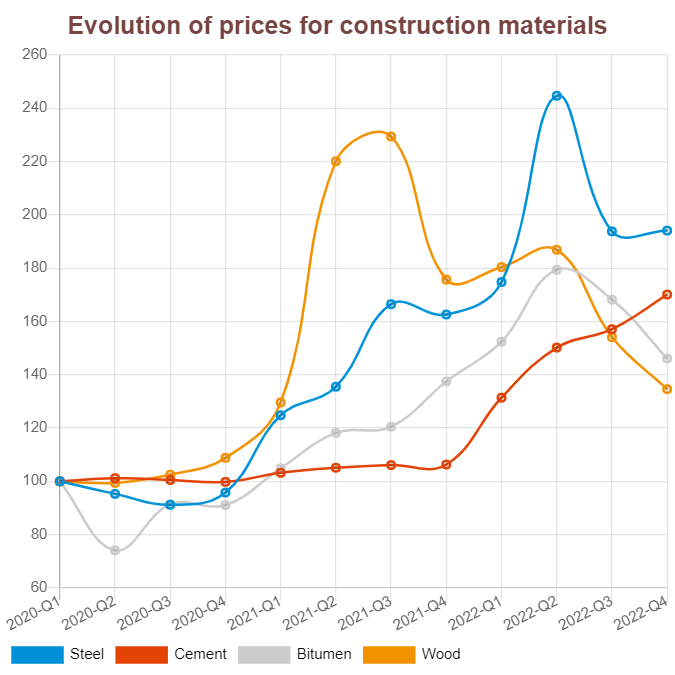

Prices of construction materials

The year 2023 started with the first signs of a slowdown in price dynamics, following a 2022 in which the costs of energy goods and raw materials climbed to a ten-year peak or, in some cases, even hit their all-time high. The available indicators show how the price increases, already recorded as early as the end of 2020, following the post-pandemic recovery, and significantly accentuated following the outbreak of the Russia-Ukraine conflict, have finally reached their peak.

More specifically, in January 2023, the price of both electricity and natural gas fell sharply compared to the values recorded in the same period of the previous year (-22,3%, and -25% respectively), reaching levels comparable to those of September 2021. Such a drop was mainly due to a lower-than-expected demand for natural gas, as the combined result of a mild winter, the reduction in household consumption, and the still high European gas stocks.

The drop in the price of energy consequently influenced the cost of plastic materials, which reported decreases, both on a monthly and on an annual basis. The price of bitumen is also decreasing, continuing the trend that started in June 2022. In January, the price of bitumen settled at levels similar to those recorded in September 2021, which however remain significantly higher than the average calculated for the months following the lockdown.

On the other hand, the prices of non-energy commodities are still increasing. In January 2023, the cost of metals was still on the rise, primarily fed by the recovery prospects of the Chinese economy due to the lift of mobility restrictions, and to the restocking carried out in the period preceding the Lunar New Year. Prices on the iron and steel markets continue to rise, reporting further increases for iron reinforcing bar (+6,4% YoY) and for copper, which during 2022 had shown a modest yearly increase of 6,1% and now recorded a further increase of 5,7% in January 2023 month-over-month (MoM).

In an attempt of contrasting those price increases and their impact on construction costs, the Italian Government introduced a number of measures in the 2023 Budget Law providing contributions in the form of tax credits to companies for the purchase of electricity and natural gas, as well as the extension to the current year of the important measures already envisaged in 2022, allocating further substantial resources to acknowledge the higher costs incurred by companies, both for the start of new construction projects and for ongoing construction sites.

Unfortunately, the measures adopted so far have proven to be ineffective in dealing with the emergency because of their long implementation times. Suffice it to consider that, as of January 2023, only 13% of the funds allocated for the higher costs of the second half of 2021, and just a mere 2% of the funds for the period January-July 2022 had been paid by the Italian Ministry of Infrastructure and Transport, and that the funds for the period August-December 2022 had just entered their investigation phase.

At this pace, companies will have to wait for years before receiving the granted financial resources, with the risk of an upcoming stop in the already initiated construction works, as well as a postponement of the time schedules for planned works, particularly those envisioned in the National Recovery and Resilience Plan (NRRP).

Per cent variation of investment in real terms of previous year

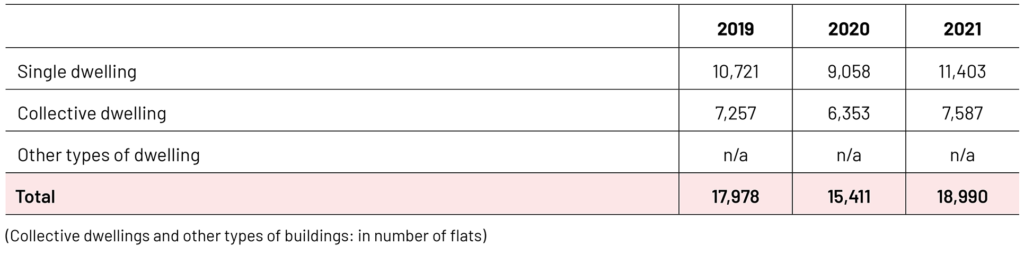

Number of building permits in residential construction