SLOVAKIA

GDP 2022

POPULATION 2024

Total investment in construction in 2022

Overall construction activity

The years 2015-2018 were years of recovery and gradual growth for the construction industry in Slovakia. In 2024, despite favourable forecasts, construction output declined, mainly due to a decline in government contracts in the transport infrastructure sector. In 2023, the decline in construction output continued as a result of the pandemic, labour shortages, stagnating demand and the unpreparedness of the public administration. The unfavourable trend continued in 2021, until 2022 was a year of stabilisation, but well below the output of 2023. The decline in 2022-2024 was due to a number of factors, most notably reduced public investment, a dramatic increase in construction costs and lengthy building permit procedures due to outdated construction legislation.

For this reason, a new Construction Act has been adopted for 2022 and will come into force in 2024. The modern law reduces procedural and administrative burdens and introduces the digitalisation of approval processes. Private sector orders are currently growing and public investment in the Recovery and Resilience Plan is also expected to grow in the coming years. One of the main risks to future development is a shortage of labour due to a decline in the labour force.

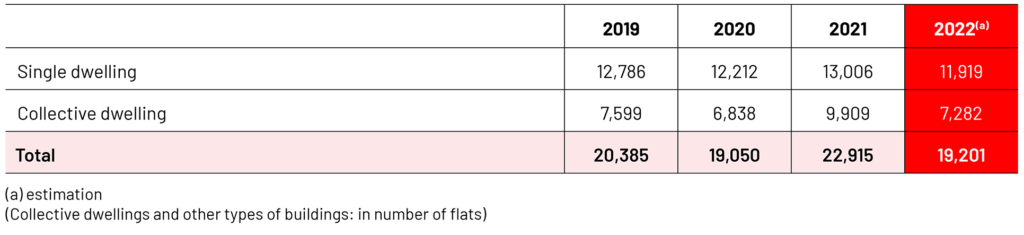

Housebuilding

The development of housing construction was a stabilising factor in 2022 — in terms of the number of dwellings completed and started, it follows the situation in 2022-2024.

Slovakia is one of the countries with the lowest number of dwellings per 100 000 inhabitants, with a long-term shortfall of around 350 000 dwellings. The housing shortage is concentrated in economically developed regions.

Reconstruction, modernisation, repair and maintenance of dwellings also account for a significant share of production in this segment. The number of new non-residential dwellings has shown an increasing trend in recent years.

Non-residential construction

Non-residential construction grew in 2022, particularly in the industrial segment. In line with this development, the total area of completed buildings and their investment costs also increased. This was particularly the case for office buildings and large shopping centres.

In 2022, the construction of public buildings — mainly schools, university campuses, medical buildings, sports and cultural facilities, including repairs — stagnated. The government is trying to speed up the construction and repair of public non-residential buildings.

Civil engineering

From 2022 to 2024, the civil engineering sector experienced a significant decline in the volume of work performed, as the public sector, the main client in civil engineering, significantly reduced its contracts from its usual share of 50% of all contracts to only 35% in 2024.

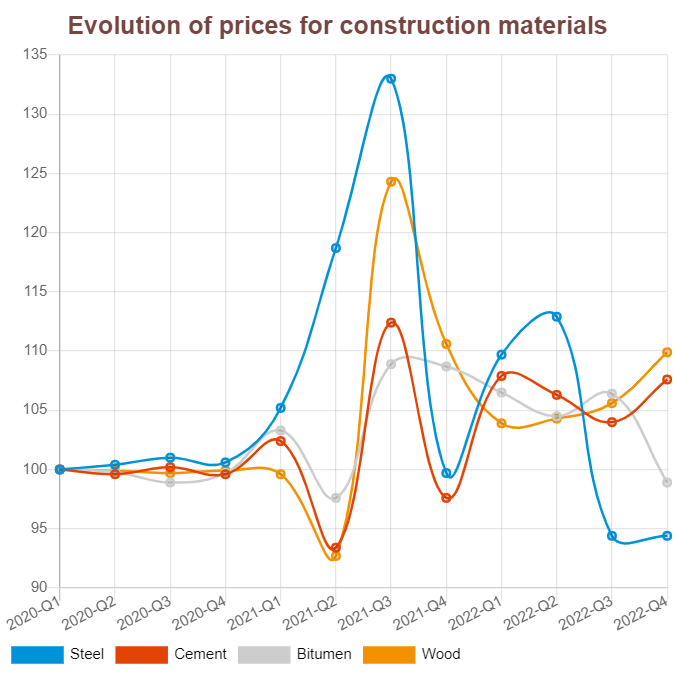

In 2024 there was a stabilisation and a halt to the decline in the civil engineering segment. However, there were still problems in 2022 caused by rapid increases in the prices of construction materials and energy, which the government was very slow to compensate for. Inadequate project preparation for new transport infrastructure projects is also causing problems.

Prices of construction materials

In 2022, the rate of increase in the price of building materials in Slovakia was reduced. At the same time, delivery times became shorter. Delivery times for sophisticated products with electronic components — building control, heating and ventilation systems — were problematic, with delivery times of 4-6 months. Delivery times are gradually decreasing. High material prices and inflation are currently having a negative impact on the willingness of residents to invest in housing.

Number of building permits in residential construction